|

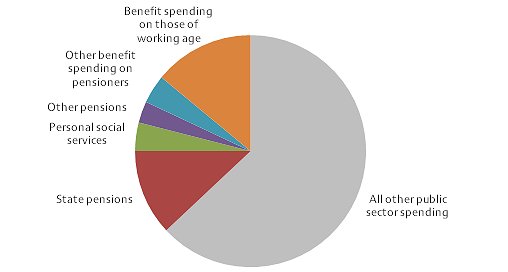

On 11 May 2015 I wrote a blog post entitled ‘welfare isn’t just about being a decent human being’. It was mainly about the impact of adverse childhood experiences and the need for the government to invest in a more preventative approach. I was encouraged today to receive a letter from my newly elected Conservative MP, Mary Robinson, in response to the concerns I outlined. She stated that she shared my “view that raising children out of poverty and giving them more life opportunities at an early age will do more than can ever be achieved through simple welfare”. I think that is the heart of the problem. Welfare isn’t simple. "Welfare" spending, according to the government’s public expenditure statistical analyses, accounts for 25% of the total and is defined as "social protection". It includes £28.5 billion on "personal social services". It includes spending on a range of things, such as looked-after children and long term care for the elderly, the sick and disabled. Unlike other elements of "social protection" it is not a cash transfer payment and in many ways has more in common with spending on health than spending on social security benefits. Another £20 billion of the spending counted under welfare is pensions to older people other than state pensions. That includes spending on public service pensions – to retired nurses, soldiers and so on. In addition to state pensions a further £28 billion is spent on pensioners, of which £15 billion goes on benefits specifically for that group, such as pension credit, attendance allowance and winter fuel payment, while the remaining £13 billion is largely spent on housing benefit and disability living allowance. So of the £205 billion or so spent on tax credits and social security benefits about £111 billion is spent on those over pension age and £94 billion on those of working age. The welfare state has changed a lot over the years and it is easy to lose sight of the principles upon which it was founded. Welfare, in my mind, is not just about cash payments but a whole system that works to protect and care for its citizens. In 1942, the Liberal politician William Beveridge, who the government set the task of discovering what kind of Britain people wanted to see after the war, declared that there were five "giants on the road to reconstruction": poverty, disease, ignorance, squalor, and idleness. To defeat these giants, he proposed setting up a welfare state with social security, a national health service, free education, council housing and full employment. Whilst the needs of the nation have changed over the years the general premise is still tangible in the Liberal Democrats constitution: no one shall be enslaved by poverty, ignorance or conformity.

Here are my thoughts in response to the points raised by Mary Robinson MP in her letter: 'The Government remains committed to its goal of eliminating child poverty by 2020' According to Mrs Robinson, the government remains committing to not just reducing but eliminating child poverty by 2020. This is a tall order for any government, particularly when all the current research points to increased child poverty by 2020. The Joseph Rowtree Foundation estimates that by 2020 one in four families will be in poverty and if this were to happen it could cost the UK £35bn in today’s terms. '300,000 fewer children are in relative poverty' While one measure suggests Mrs Robinson is right, another can as easily be used to say she’s wrong. There’s no single definition of ‘child poverty’ in the UK. Official bodies measure it in three main ways. The first, takes a certain ‘low’ level of income and counts how many children live in households at or below that level. The second finds out the ‘middle’ income nationally and counts children who live in households earning less than 60% of it. This is known as the ‘relative’ poverty measure and is the one the Mrs Robinson was referring to. The other way is to count children in families which have poor living standards. For example, where there’s no safe place to play outdoors or they can’t afford things like school trips. So, there are 300,000 fewer children living in ‘relative’ poverty but this isn’t always a useful measure. As the government itself has conceded, when everyone’s income falls, this can mean poverty falling as well, which isn’t very intuitive. 'A record 31.1 million people in work' This latest round of figures put the employment rate at 73.5 per cent, it’s highest since records began in 1971. However, of the current 31.1 million working people in the UK at the end of March, only 53% are full time employees on someone’s payroll. The other 47% are what are referred to as ‘Self Drive Workers’ who are not dependent on one employer for their total income. In broad terms, this 47% have to find their own work. The UK has been moving away from this traditional work model for some years - and now it has become significant. Furthermore, data also shows us that there were 697,000 people on zero hour contracts in October-December 2014, compared with 586,000 in October-December 2013. The proportion of workers on a zero hour contract in October-December from 2000-2012 was under 1%. In 2013, it hit 2%. In 2014, it was 2.3%. A provision in the Small Business, Enterprise and Employment Act 2015, which was passed under the Liberal-Conservative coalition government and came into force on 26 May 2015, intended to ban clauses that allow employers to block zero-hours employees from holding jobs elsewhere; however, it has been described as toothless by lawyers. 'Poor children are doing better than ever at school' Research shows that of those eligible for free school meals in 2008/09, 73.3% did not achieve at least 5 GCSEs A* to C (including English and Maths) compared to 45.5% of pupils not eligible for free school meals. In 2013/14, 63% did not achieve at least 5 GCSEs A* to C (including English and Maths) compared to 35.8% of pupils not eligible for free school meals. However, the Joseph Rowtree Foundation warns that it is not possible to directly compare 2013/14 figures with earlier years due to the changes in methodology. Nevertheless, I would credit some of the improvement, whatever it might be, with the introduction of the pupil premium. 'The Pupil Premium is supporting poor children in reaching their full potential and helping to close the attainment gap' While, there is no doubt that the pupil premium was included in the Tory manifesto before the 2010 election, it has widely been accepted that the idea for an additional sum of money to go to students in receipt of free school meals not only came from the Lib Dems, but was the idea of Deputy Prime Minister Nick Clegg. Indeed, it is understood Mr Clegg first put forward the idea of a pupil premium back in 2002. 'The personal allowance has been raised to £10,600' Raising the personal allowance was a Liberal Democrat red line in 2010, which they delivered despite David Cameron telling the nation it was ‘unaffordable’. Indeed, increases in the personal tax allowance have improved the circumstances for many families in in-work poverty, but the most recent increase will not help those most in need who already have earnings below the tax threshold. Furthermore, under Universal Credit, 65% of any additional income recipients get from an increased tax allowance they will lose through reduced entitlement to Universal Credit. In March, the Chancellor set out in his budget the path of income tax bands from 2015/16 to 2017/18; raising the personal tax allowance to £11,000, and the higher rate threshold, to £43,300. This sounds great, but because tax bands are up-rated by inflation anyway, delaying the £11,000 by two years substantially reduces the benefit to taxpayers. In the absence of any policy intervention, the personal tax allowance would be expected to rise to around £10,760 in 2017/18 anyway. This means the announced measure is a rise of just £240, and a benefit of £48 in reduced tax for basic rate taxpayers, rather than the £80 they would receive had it been implemented this year. Conversely, the rise in the higher rate threshold is £400 higher than where it would fall if increased in line with inflation. Universal Credit will lift around 300,000 children out of poverty thanks to increased entitlement Universal Credit is a single monthly payment for people in or out of work, and will merge together some of the benefits and tax credits that they might be getting now. Universal Credit was launched in October 2013 with a gradual transition to be complete by 2017, replacing:

The good news is that it’s supposed to be simpler and there are no limits on how many hours a week people can work if they’re claiming Universal Credit. Instead, the amount they get will gradually reduce as they earn more, so they won’t lose all their benefits at once. You can find out more at the Money Advice Service. It is thought that Universal Credit will lead to an increase in employment due to improved financial incentives, simpler and more transparent system, and changes to the requirements placed on claimants. Overall, it is said, this could lead to the equivalent of up to 300,000 additional people in work from improved financial incentives. This is not the same as lifting 300,000 children out of poverty. There is cross-party support for the theory behind the benefit, but its delivery has been delayed and criticised. Unite union has claimed that it creates a division between a "deserving" and an "undeserving poor". In its initial estimate of the new system, the Institute for Fiscal Studies have said that the poorest are likely to do better, especially couples with children. However, the second earner in a family is likely to lose out in the long-term in many cases. Some charities have argued that, because of a broad-brush approach that universal credit takes, those with more complex benefit claims may lose out, such as some people with disabilities who go to work. Also, those without a bank account, or who do not have internet access, will have to seek advice to prepare for the new way this benefit is run and paid. Minimum wage increased by the largest amount in six years The 2014 increase in the adult rate lifted the real value of the minimum wage for the first time in 6 years through the biggest percentage increase since 2008. Great! Speaking at the Liberal Democrats party conference in Glasgow on 14 September 2013 it was Vince Cable that pressed for an increase in the minimum wage amid concerns that the lower-paid workers were still not benefiting from the “burgeoning economic recovery”. George Osborne on the other hand spoke on the 10 January 2014 to warn that a “self-defeating” increase to the minimum wage could cost jobs. Thankfully, on the 16 January 2014 he had a change of heart. Perhaps it was the Lib Dems that told him the “economy can now afford” to raise the rate? I agree that “there remains much work to be done”. The Joseph Rowntree Foundation is currently developing an anti-poverty strategy for the UK. As a part of this four year programme they have undertaken a review of effective strategies across the EU to determine their key characteristics. This review suggested that key to an effective strategy are clear mechanisms of responsibility and accountability, implementation plans and a monitoring and review process. It also found that clearly linking strategies to economic policy made them more effective. They assert that the Child Poverty Strategy 2014-17 (referred to in Mrs Robinson’s letter) does not sufficiently meet these criteria. In particular, while it does include some steps necessary to address child poverty, it neither assesses the impact of these measures upon child poverty, nor does it include milestones by which it can be held accountable during the course of its three years. In short, it does not offer any mechanism of accountability beyond achieving a reduction in the total number of children in poverty by 2017. Furthermore, it does not account for the impact of further reductions to welfare budgets over the coming year, which research for JRF by the Institute for Fiscal Studies shows is likely to significantly increase the number of children in poverty. The JRF report suggested that the impact of changes to personal tax and benefit policy announced by the coalition government is likely to increase both relative child poverty by 200,000 in 2015/16 and absolute child poverty by 200,000 in 2015/16. It would seem there is indeed much more to do. I concluded my previous post by saying that Local Authorities need greater funding to hire more social workers so that caseloads are at a manageable level where they have the time to undertake intensive direct work with families again. The government needs to fund preventative and outreach services that can directly tackle problems before children become at risk of significant harm. Instead, proposals have been tabled to jail social workers who fail to prevent neglect, despite the necessary infrastructure to properly address it; and the shock result of a Conservative majority victory signals deeper, faster cuts than ever before. None of these points were addressed in Mrs Robinson's letter. Perhaps this was an oversight and I would welcome further dialogue. Communitycare has urged Social Workers to channel whatever they are feeling about the election result into something that isn't apathy. I have only just begun... Thanks for reading! Follow me on facebook and twitter to see future posts.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorI'm a Qualified Children's Social Worker with a passion for safeguarding and family support in the UK. Archives

August 2016

Categories

All

|